The Rising Star Of The Spirits World: Bourbon

Consumers around the globe are now consuming more bourbon than ever before, with annual output up by 116% over the past 10 years. In addition to surging demand, the market for collectible bourbon is just on the cusp of breaking out. Bottles of rare bourbon have amazed the industry by fetching more than $20,000 at auction. Even production bottles now sell regularly for more than $4,000 on the secondary market. As consumers begin to view high-end bourbon as a luxury, status symbol and worthy indulgence; it is expected that values will rise significantly in the years to come. The “Bourbon Boom” is here.

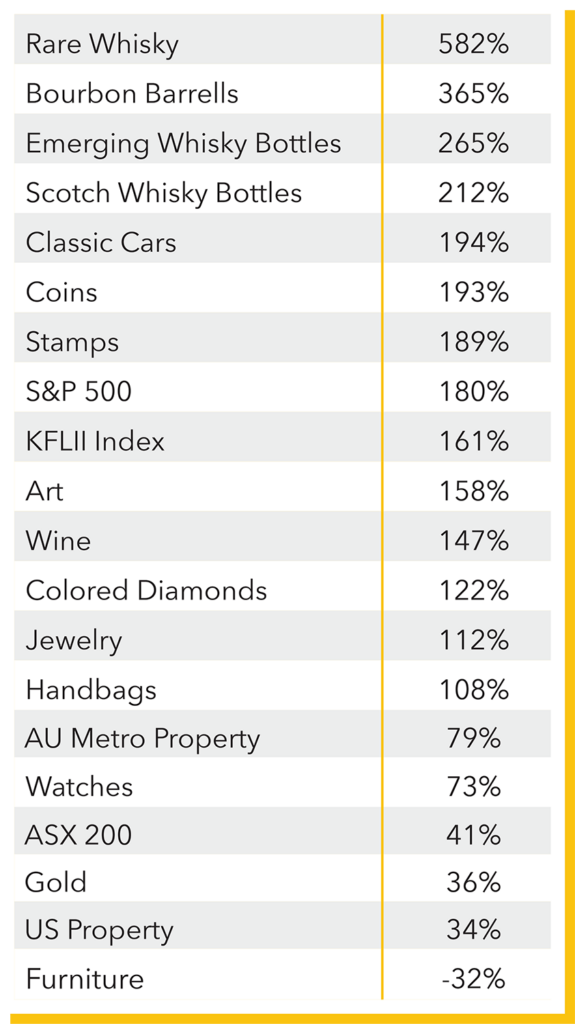

How Does Bourbon Investment Stack Up?

Barreled bourbon has shown exceptional stability and consistency in performance over the long-term. These characteristics make bourbon casks an important holding for strategic investors looking to diversify their portfolio with an asset that offers unparalleled resilience across economic cycles.

Since 2010, prices for bourbon casks have appreciated on average 13.85% per year on average, depending on the distillery and age. In comparison to other asset classes, bourbon has outpaced nearly every other category. The lone exception being rare scotch whisky bottles as tracked by the Knight Frank Luxury Index.

Of particular significance, this appreciation has statistically been un-correlated to the stock and bond markets. This is an important consideration for investors seeking a diversified portfolio with a hedge protecting against declines in traditional investment holdings.

Distillery Direct Relationships

Building strong long term relationships with bourbon distilleries across the United States is a cornerstone of the CaskX investment platform. By working directly with distillers, CaskX is able to secure more lucrative and secure opportunities for investors. These connections also provide additional monetization strategies through distillery buy-backs and bottling arrangements.

Stringent Oversight & Investor Protections

In the United States all whiskey production falls under the three tier system whereby every distillery must receive a federal license before production can begin. Upon receiving the license the distillery must comply with strict laws governing distillation, storage, transportation and bottling of all spirits. Every cask purchased by an investor must continue to be stored at one of these licensed facilities for the term of their investment. Distilleries are careful to always ensure compliance due to the significant penalties levied for any discrepancies. When combined with the safeguards put in place by the SEC, FDA and other governing bodies, the United States is arguably the most secure market for whiskey investors.

Request Access To Current Bourbon Investments

Enter your information to receive access to available bourbon investments.